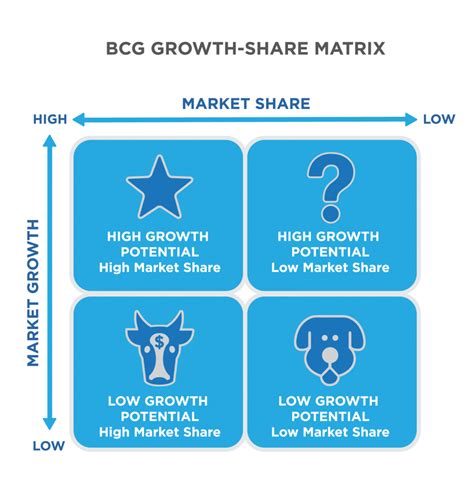

lvmh bcg matrix The growth share matrix was created by BCG founder Bruce Henderson in 1968. It was published in BCG in-house magazine called – Perspectives. The Growth Share matrix is a . DELLA® Latvija Pareizai darbību vietas DELLA ir ieslēgt JavaScript savā pārlūkprogrammā uzstādījumus un mēģiniet vēlreiz, lai ielādētu lapu . Ja Jums ir interese tirgū kravu pārvadājumu, kravu Ukrainā (autopārvadājumi Ukraina) vai starptautisko kravu autopārvadājumi (starptautiskā kuģošanas) - lūdzu, vienmēr esam .

0 · bcg matrix luxury

1 · bcg matrix logo

2 · bcg matrix

Kas ir depresija? Kā atpazīt simptomus? Depresijas cēloņi; Depresija Latvijā; Pašnovērtēšanas tests; Caмотестирование

This brand is managed by Louis Vuitton Moët Hennessy (LVMH), a European firm that envisions providing elegant and creative luxury products to its customers. The core business of this corporation falls under five categories: .The growth share matrix was created by BCG founder Bruce Henderson in 1968. It was published in BCG in-house magazine called – Perspectives. The Growth Share matrix is a . The document provides an analysis of LVMH's business strategy for its perfumes and cosmetics segment in the United States. It includes an overview of LVMH's profile, mission, values and goals. It then analyzes . PDF | As the luxury goods industry secures a prominent position within the global market, the leading conglomerate LVMH Moët Hennessy Louis Vuitton. | Find, read and cite all the research you.

The analysis examines various factors that affect LVMH's investment value, including financial performance, market position, brand strength, management quality, and external environmental. BCG Matrix in the Marketing strategy of Louis Vuitton – In the BCG matrix its apparel business, ready to wear leather items and sunglasses is Stars while shoes, watches and jewellery are question marks in the BCG matrix .

1.1. Brief presentation of LVMH LVMH Moët Hennessy • Louis Vuitton, better known as LVMH, is a French multinational group, which owns more than 60 prestigious brands around the globe. .

The Boston Consulting Group Matrix (BCG Matrix), also referred to as the product portfolio matrix, is a business planning tool used to evaluate the strategic position of a firm’s brand portfolio. The BCG Matrix is one of the most . This document provides an analysis of LVMH's competitive strategies. It examines LVMH's positioning using Porter's five forces model and generic strategies of differentiation and focus. LVMH's core competencies . How can one analyze this continuous growth? What are the key elements of the group's strategy that allow LVMH to remain top of the class? LVMH enjoyed exceptional .Recommendations Non- core luxury businesses can be divested (media business , art auctions) LVMH International Strategy LVMH International Strategy Shabnam Tahernia LVMH BCG Matrix LVMH is present in the media sector .

The BCG matrix, with its simple yet powerful approach to portfolio analysis, will undoubtedly continue to play a role in shaping those strategies. In the dynamic world of business strategy, the BCG matrix offers a time-tested .For LVMH, the BCG matrix is designed to understand which product categories are performing well in all the countries both in terms of growth and market share, which product category is just providing cash to the company, or which .Cash Cows. The supplier management service strategic business unit is a cash cow in the BCG matrix of LVMH New Generation New Image. This has been in operation for over decades and has earned LVMH New Generation New Image a significant amount in revenue.1.1. Brief presentation of LVMH LVMH Moët Hennessy • Louis Vuitton, better known as LVMH, is a French multinational group, which owns more than 60 prestigious brands around the globe. The group has its headquarters in Paris, and it is chaired by Bernard Arnault, the tenth wealthiest man in .

BCG of Louis Vuitton - Free download as Powerpoint Presentation (.ppt / .pptx), PDF File (.pdf), Text File (.txt) or view presentation slides online. The document provides a BCG matrix analysis of strategic business units for Louis Vuitton. It identifies stars, cash cows, question marks, and dogs. For stars like financial services and top brands, it recommends investing through .

The BCG Matrix was introduced almost 50 years ago, and is today considered one of the most iconic strategic planning techniques. Using management fashion theory as a theoretical lens, this paper . LVMH (Louis Vuitton Moët Hennessy) est un groupe dont l'existence est assez jeune. À l'origine se trouve le rapprochement en juin 1987 des entreprises Moët Hennessy (fabricant de champagne et de cognac) et de Louis Vuitton (mode et maroquinerie de luxe).Par la suite, c'est le business man Bernard Arnault qui devient actionnaire majoritaire - via sa holding .McKinsey matrix analysis The position in the market for Fashion & leather goods and Watches & Jewelry is very important, LVMH is an important competitor and one of the leaders in these two business units Wines & Spritis and Perfume & Cosmetics has an average atractiveness but aThe BCG matrix was created by Bruce Henderson as a tool to assess the potential of any given company’s products and services, and then advise which ones a company should keep, sell, or invest more in.

Strong Parent company: LVMH (Moët Hennessy Louis Vuitton), a multinational luxury goods provider is the parent company of Louis Vuitton. It has dedicated 125000+ employees across the globe. LVMH is financially strong . The essay intends to apply the BCG and Ansoff matrix to the Louis Vuitton company and present recommendations to help boost the company's productivity in the post-pandemic era. . The brand Louis Vuitton is . 2. BCG Matrix of Samsung. Samsung, a global leader in electronics, provides an intriguing example of the BCG Matrix in action. With a diverse product portfolio spanning smartphones, home appliances, and semiconductors, Samsung’s BCG Matrix analysis helps prioritize investments and resources across different business segments. LVMH -2016-2021 Debt to Asset Ratio. During this six-year period, there were two huge jumps that are 2018 to 2019 and 2019 to 2020. The first jump between 2018 to 2019 has a 6% increase from 54.3% .

LVMH is a French multinational luxury goods conglomerate that was founded in 1987 through the merger of two companies, Moët Hennessy and Louis Vuitton.The company’s name is an acronym for its two original brands, Moët Hennessy and Louis Vuitton. LVMH’s portfolio of brands includes over 70 prestigious names in fashion, leather goods, perfumes, . LVMH is a French multinational corporation that was created in 1987 with the merger of two companies, Louis Vuitton and Moet Hennessy. . The BCG matrix would suggest that a large portion of this .

The BCG Matrix focuses on 2 different Variables: Market Growth. Market Share. With these 2 variables, the BCG Matrix categorizes a product and what a company can expect from it. On the other hand, the Ansoff Matrix focus on what Strategy bcg matrix and vrio framework for louis vuitton a company should follow. These 2 Matrices use different .

This unity of creativity and innovation is our Maisons’ foundation and is at the center of a delicate equation: updating our products and being resolutely forward-thinking while also continuing to stay true to our heritage and traditions to create products that will stand the test of time.

hublot big bang carbon replica

bcg matrix luxury

bcg matrix logo

Lai spriestu, jāzinaНовости Латвии и мира, анализ, мнения и комментарии, репортажи, фотогалереи. DELFI - ведущий новостной портал в Латвии.

lvmh bcg matrix|bcg matrix